China A-share ETF size has grown each of the last six months to 1.64T RMB ($236b), up nearly 26% YoY.

Historically, China ETFs have significantly underperformed U.S. ETFs, due largely to the market’s notorious volatility. That volatility is one of the key pillars underlying our position that active management in China is generally well worth the fees. Of course, High China Conviction looks for market wisdom largely to China’s top fund managers, so the “asking the barber if you need a haircut” principle applies.

That aside, robust growth in China ETFs means three things:

- The maturing and diversification of ETF products

- The acceptance of ETFs by more investors in Chinese equities

- The availability of previously off-market funds through ETF products

CHINA TECH ≠ CHINA GROWTH

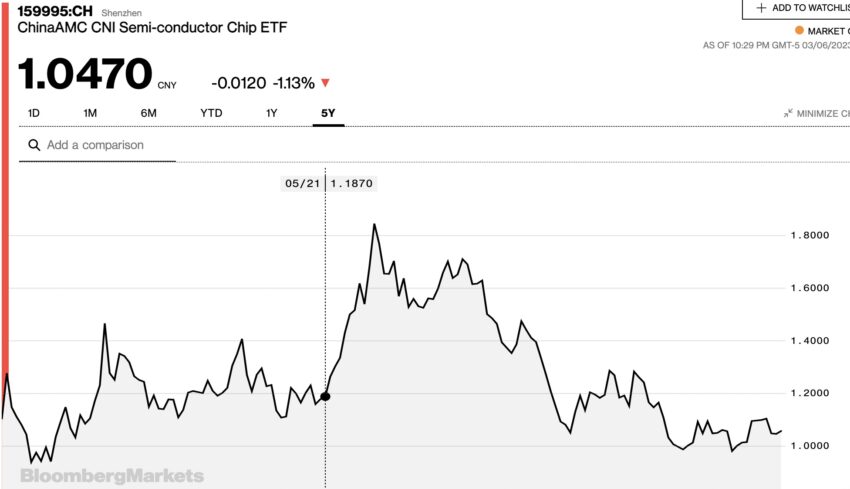

The biggest China ETF gainer? Huaxia Guozheng Semiconductor Chip ETF, up 3.87b shares for the year, demonstrating that Chinese investors are quick to leverage geo-macro trends. To underline the point, Guolianan CSI All-Referring Semiconductor ETF has also increased by more than 3 billion shares. So too has Huaxia Shanghai Science and Technology Innovation Board 50ETF, to the point of tech ETF growth in general.

While most U.S. tech giants are growth stocks, Chinese investors see far less linkage between the two themes. Growth-themed China ETFs have actually seen outflows amidst the general uplift of the past half year, most notably Invesco Great Wall ChiNext 50ETF, which decreased by 5.2b shares over the year.

WHAT IT MEANS FOR THE A-SHARE MARKET

Growth of ETFs can be taken as an overall sign of a maturing market, with increased diversification more easily available to the average Chinese investor.

However, an excellent study of the A-share market concludes that ETF activity reduced idiosyncratic volatility while increasing systematic volatility. Idiosyncratic reduction was greater, for a net reduction in volatility.

Thus, we’d suggest that growth of ETFs in China will not affect overall volatility, and that the increased liquidity and volume will offer more opportunities for experienced fund managers to capture idiosyncratic alpha.