Chinese stocks remain down, so they’re “out”.

Think China is uninvestable right now?

Maybe you’re right. For right now….

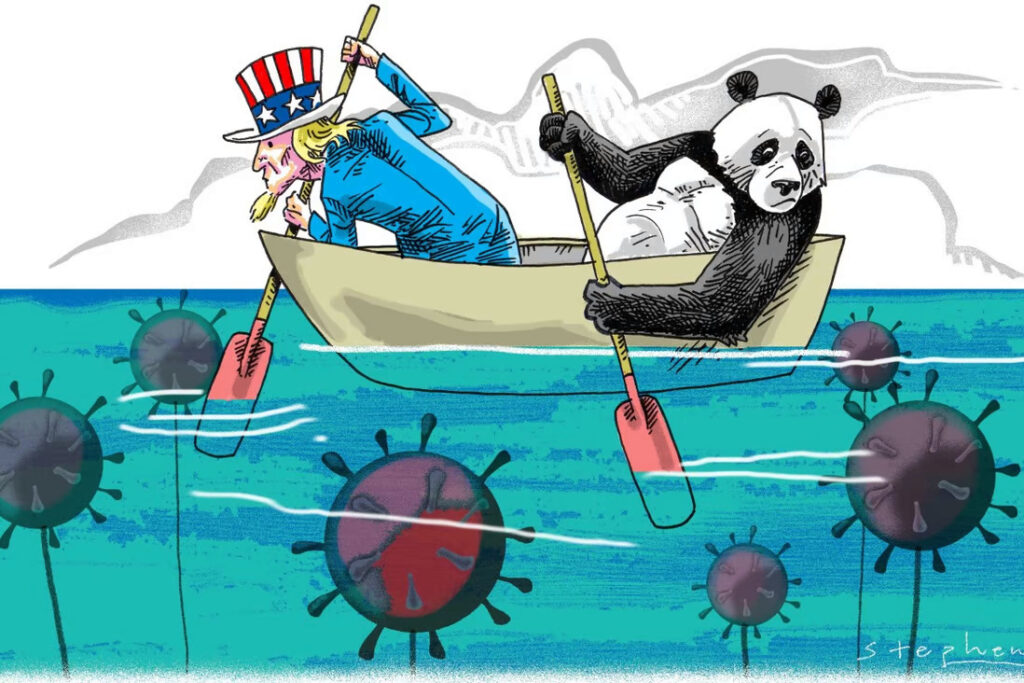

After all, China’s financial hub, Shanghai, is on lockdown. Granted, financial workers are ordered to sleep in their offices, lest the gears grind to a complete halt. But still, this stubborn commitment to Zero Covid speaks to anything but a “market first” mentality.

And we mustn’t discount exogenous factors that China is powerless to control. Namely, the existential threat of American sanctions. This putative enemy of America must be an enemy of America’s enemies, else risk showing that she doesn’t even want to redeem herself, and be an obedient friend someday.

As a result of all this uncertainty, onshore markets languish in continual doldrums. Thus our unwillingness to opine to foreign investors that now is a good time to allocate, when Chinese investors themselves remain so leery.

Keep in mind, of course, that eighty percent of China market volume, holding steady at over USD150 billion a day, comes from retail trade. Retail traders, as you know, are famous for being price/trend sensitive and value-averse. They aspire to technical proficiency and short term alpha, but shy away from fundamental analysis and long-term appreciation. The latter two, lest we forget, are the pillars of what separate a disciplined, responsible, institutional investor from the day-traders and other chronic underperformers.

Still, if you are reading this and you’re an institutional investor, we have statistically-significant data, culled from a sample size of hundreds, to make odds that you’re thinking, “China? Too risky right now.”

Correct. We’d love to know what your unique calculus of risk/reward is for emerging market China. We’d love to know the method behind that calculus. Bad news and resultant conjecture can factor heavily. For example, “Oh God, China is still battling COVID? How long is this going to go on, with the lockdowns and the economic drag – another five years? Ten?”

We wish we could tell you, truly. Being on-the-ground in Beijing and Shanghai and Hong Kong doesn’t give us oracular powers. We hear everything, from China about to introduce the be-all, end-all super vaccine, to leadership needing everyone on lockdown until the fall meetings, to prevent rumored terrorist attack by keeping a bead on everybody.

It’s the year of the tiger here in China. Fittingly, in his last call with President Biden, President Xi concluded by telling his counterpart, “He who tied the bell to the tiger must take it off.”

Some might describe the 2% of symptomatic cases among the thousand-odd new cases per day in Shanghai, a fairly faint bell. But until China takes that bell off, Chinese stocks will remain volatile, underperforming, and dare we say…undervalued?