CHINA MACRO

A Separate Peace

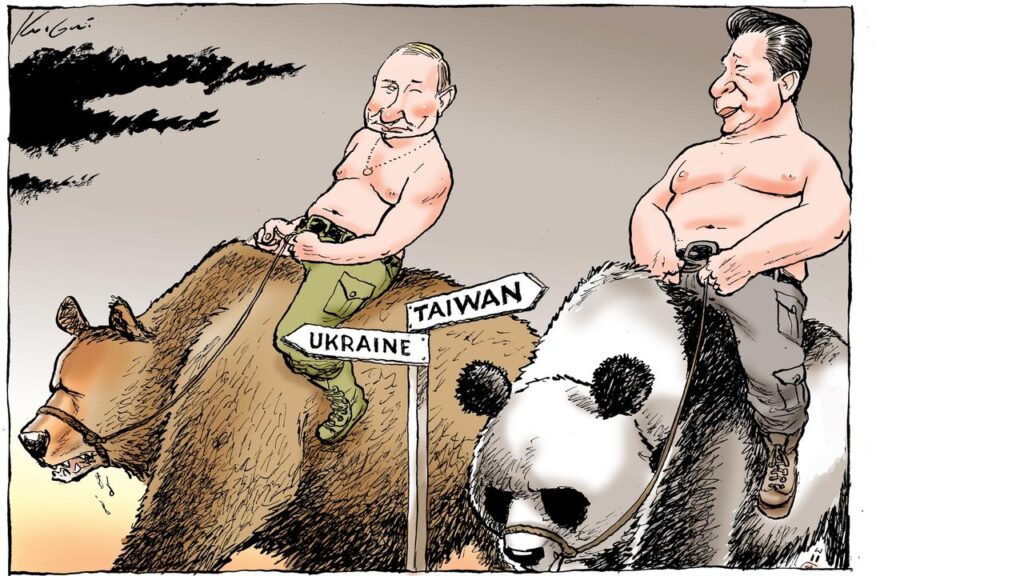

The outlook for financial markets has been overshadowed by war. Increased risk & drag on growth threaten global economic prospects, but particularly for NATO countries.

Suddenly, East Asia, powered by the growth engine that is China, beckons as a haven of stability and “business first” policies. Logic dictates a two-part dynamic that will kick the Asian Century into overdrive:

- America much too preoccupied with its NATO allies and Russia to be meaningfully pursuing its China containment agenda.

- China’s key role in the RCEP, and the RCEP region’s relative lack of correlation with the political turmoil threatening Europe, and by extension America.

The truth can be unsettling, especially when it clashes with established maps of reality. On the geopolitical map, however, besides RCEP, China is in a much better position to trade with resource-rich Afghanistan & Africa, energy-rich Russia & Iran, and BRI-friendly South America than the established world order. Extrapolate GDP growth and other economic metrics accordingly.

And as any sensible wealth manager might tell you, “Drawdowns driven by geopolitical stress events are typically short-lived for well diversified portfolios.”

March Gladness

Chinese await the decisions of the National People’s Congress as breathlessly as Americans await the pronouncements of their Lords of Fate, the Fed. Credit easing started in response to last year’s real estate global contagion, make that China market collapse, make that ongoing challenge.

But it won’t be official until the NPC says so, which Chinese bookmakers are giving 20 to 1 odds on. Quality growth is still the grand objective, but you can’t eat robots, and shuttered factories emit zero CO2, but a whole lot of unhappy consequences, besides .

An official pro-loosening stance should modestly raise hopes and earnings until the year’s real lollapalooza, the Communist Party National Congress, this fall. Confidence in loosened economic policy will be confirmed along with the country’s top leadership.

China Markets

Old Fashioned Values

Not our favorite index, but the one of China record, the CSI 300, is down more than 15% from a year ago. Then again, institutional investors note well that it is up more than 33% from five years ago.

Should we be looking at reversion to the mean, and perhaps a seldom-heeded signal to make value an actionable theme, as it is increasingly in the West?

Perhaps, but keep in mind that China’s fundamental story is still one of growth, which can be expected to expand once the credit belt is officially loosened. Yes, increased fed rates will continue to ding all-important earnings, but this will be a market-wide headwind.

Meanwhile, increased confidence in a moderately growing Chinese economy, triggered by factors such as slowing declines in real estate prices, have A-shares daily turnover up above the symbolic RMB 1 trillion mark again. Never forget that the domestic market is 80% retail driven, and likewise driven by hopes of picks growing as quickly as spring scallions, rather than all that bother of finding companies which are fundamentally undervalued.

Terminator X: Lies of the Machine

As late as last October, Chinese quant funds were the in thing, with three-digit returns the rule, rather than the exception. No wisdom was needed to beat the unschooled crowds, other than that required to manage an autistic machine-learning specialist.

Like all shooting stars, the run was bright but doomed. Only a quarter managed positive returns for Q4 ’21. As ’22 progresses, losses and shut-downs are mounting. Too big, too fast, an all too familiar story in western financial news sheets. Add the rumored specter of pending government scrutiny; this could end up going from cautionary tale to tear-jerker.

Sound Bites