Is What You (as an institutional investor) Need to Know About China

“It ain’t what you don’t know that gets you. It’s what you do know that just ain’t so.”

– Mark Twain

Common Thinking is Not Common Sense

I went to a working class high school. The few friends from there I’m still in touch with aren’t the type to use six-syllable words often. Yet they’ve all informed me I live under a “totalitarian regime.”

I’m fairly certain they didn’t all choose the same words after careful consideration, but rather heard the phrase enough times to incorporate it.

Even more of my non-China contacts have boiled down China’s Covid policy to another suspiciously consistent message: “It’s not about safety…it’s about control.”

To interpolate from that theory:

1. The CPC felt they were losing control.

2. Crippling the economy and causing massive discontent was deemed an acceptable price to pay for reestablishing this lagging control.

3. Central planners threw darts at maps to determine which neighborhoods and communities to lock down and ramp up control. Element of surprise, and all that.

An Inconvenient Truth

The second and last time I’ve been locked down in my community was two weeks ago, for three days. The community directly behind mine wasn’t. The one across the street was.

Control darts aside, the decision to lockdown my community came not from the Beijing government, or even a Beijing district government, but rather sub-district authorities, based on number of live and close contact cases in the neighborhood. More efficient than throwing darts. More effective, too. For safety, if not control.

It’s also more exploitable. Those sub-district authorities decide which private, for-profit health companies set up testing booths, administer quarantine centers, and other ostensibly “public” health services. It’s devolved into a racket for minor officials, a racket unrivaled since the Kangxi emperor delegated rice tax levies to village gentry.

From Grift to Policy Shift

False positives, quarantine centers with symptomatic and asymptomatic people carelessly grouped together (all victims must pay for their quarantining) – the abuse has been persistent, and increasingly egregious. This grass roots corruption is what has driven folks to the point where the Urumqi hotel fire was enough of a flashpoint to trigger the very well-covered protests.

Of course the calls for Xi to step down were heard at a few of those protests, predictably those at colleges.

Results: no more lockdowns, no more mandatory testing.

No more Xi, let alone CPC? That’s a forecast only CNN reporters should pretend to take seriously.

Enterprise Always Finds a Way

The foregoing is intended not just as some counter-narrative insight, but to point out that, no matter the situation, the enterprising will always find a way to profit, in good times and bad.

Sadly, sweeping government emergency responses will always create bad faith enterprise, too. Has anyone audited the $1.9 trillion American Rescue Plan yet?

But do keep in mind that China is a place where constructive enterprise finds a way to flourish as well, no matter the six-syllable labels people learn to describe it.

Chinese Managers Fund Away

This brings us to China’s long-laboring, ever-volatile equity markets. Bogleheads and other indexing fans have plenty of historical support against investing in China’s domestic stocks. Buying the CSI300 is no magic formula for long-term capital appreciation, like buying the S&P 500 is used to be.

The lack of U.S.-style, Fed-backed market growth has kept more than a few investors away. So has fear of an authoritarian regime. Thus a little more micro insight is in order, some narrative-disrupting facts.

1. China is chock-a-block with fund managers who hit the glass ceiling at Morgan Stanley, Goldman Sachs, after getting their masters and PhDs in finance at renowned universities.

2. They have applied their prodigious talent to taking in both the bad differences (higher historic volatility) and good (80% retail traded) between China and U.S. markets.

3. They offer as broad an array of management/investing styles as one could hope to find anywhere in the world, from the most fundamental, bottom-up, “buy a quality company at a quality price and wait” to the most cutting-edge quant, AI-enhanced, high-frequency momentum trading strategies.

Meet a China Manager

I have the privilege of talking to such managers on a regular basis. Almost all have fluent or near-fluent English skills. All welcome foreign investors to discuss investment goals and how their strategies may or may not suit. All understand the latent macro and media-driven concerns keeping such investors on the fence.

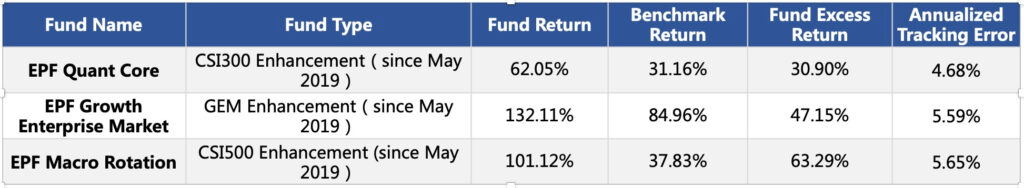

All share their latest tear sheets with performance figures, to wit:

The above outperformance comes courtesy of fund manager Dr. Jin, a standout in a field of standout Chinese managers who have clambered up the ladder from prestigious degrees to PMs and directors at massive western AMs, before being drawn to the China A-share opportunity.

Doesn’t Mr. Jin know Taiwan could be invaded any day? Or that the existential threat of authoritarianism, demographic challenges and real estate collapse make China uninvestable?

No, he doesn’t know that, to a degree that would make Mark Twain proud.

What he knows is constructing models based on historically-verified signals drawn primarily from momentum indicators. What he believes is that predicting markets is arrogant and unsustainable. Let the markets do the talking, and if they’re talking sh*t, reduce exposure accordingly.

Such are the interesting, accomplished, and highly experienced fund managers Tirith helps our clients allocate to. Most of them are available for a call with just a few days’ notice. All are risk-managed against both what they don’t know, and knowing what just ain’t so.