Increased Tensions Make Increased Global Diversification Increasingly Risky

Dedication: Damn the Consequences

This edition of High China Conviction is for you, Nancy Pelosi. Because if there’s one principle left all Americans can agree on, it’s that NO ONE tells Americans what they can or can’t do.

To hell with the consequences, or the past promises.

Promised – no NATO expansion after the Berlin Wall fell.

Promised – one China, unification to be strictly an issue between the PRC and ROC (Shanghai Communique, 1972).

Consequences of stoking Ukraine NATO ambitions – invasion, weaponization of the dollar in response. Good for America’s last great industry, terrible for everyone else, and a catalyst for ending dollar domination (remember the countries that sanctioned Russia represent a mere 16% of the world’s population.)

Consequences of implying Taiwan can deal with the PRC as it pleases, with full American backing? No invasion. A lot of bluster. So far.

Winning the Battle: Whence the War?

You may well imagine some excitable PLA general fulminating to the central committee, “They gave up in Afghanistan! They’re not sending troops to the Ukraine! Now’s the time to strike; when they’re weak!”

But the truth is that America is far from weak, militarily or economically, a fact not lost on the highly intelligent administrative masters who compose that central committee.

A fact lost on most westerners, however, is just how capable and intelligent those members are. The myth of god-king Xi, single-handedly and peremptorily steering China’s ship, is ruinous to any kind of firm grasp on its foreign and economic policy. It’s comforting to believe otherwise, of course, but for the many who need cobweb-clearing, this Twitter thread aptly summarizes the gubernatorial gauntlet that allows only the best and brightest to the nation’s top levels of administration.

So there will be no fight, and America has made it plain there will be no respectful diplomacy. The consequences of Pelosi’s chip-stacking junket will be alienation and acceleration.

Acceleration of Chinese military preparedness on all levels. Acceleration of new regional alliances that reduce dependence on American markets and the dollar. And, to the point for our small but growing band of those who dare to think different, acceleration of its domestic markets’ growth, consumer and equity, in order to secure a future much less reliant on the whims of the Rules Based Order, however evil or misguided one may take that motivation to be.

Put yourself in the shoes of Liu Kun, China’s Minister of Finance. Dispense with the notion that his chief concern is cynically lining his pockets until his term is over. That would be Nancy – Chinese officials get executed for those hijinx nowadays. How wise is it to continue to rely on American markets as a key source of capital formation for the companies driving Chinese innovation and industry growth?

China Must Cultivate Its Capital Gardens

Takeaway 1: the quest to grow China’s domestic equity markets continues and grows even more urgent, as a matter of not just international but also internal pressure. After all, an obvious answer to Chinese families’ over-reliance on real estate for wealth is increased allocation to equities.

But then the question to the takeaway: are Chinese markets still “uninvestable”? Here’s the irony- the term “uninvestable” began as a Goldman Sachs meme more than a year ago, and was referring to U.S.-listed Chinese companies. Mighty is the meme power of GS – the NASDAQ Golden Dragon Index is down almost 40% since then, with some formerly frothy giants trading at less than their liquidation value.

Our job is to make the case for A-shares, as (dare we say) a no-brainer for a truly diversified portfolio.

Baked in Bottom, But No Easy Rides

The last anyone reported on China’s official encouragement of increased retail and institutional participation in equity markets, back in April, the soundbites spoke to how risky those markets were.

Hopefully it’s not immodest to point out that your writer called the nadir less than a month later (they save the best quote for last). My “secret indicator”? The second CSI 300 lockdown low, 3908, never fell to the first lockdown low, 3653.

Right now any institutional investor who has been in the game a while knows that this is the time to be holding a lot of cash, dollars, for the nonce.

Comparing Crises

As for stock allocations, our daily grind is speaking to the Chinese crisis du jour, that long-awaited trigger that will send this whole economic house of cards a’crumbling, in fulfillment of the “Coming Collapse of China” scripture, penned these two decades past by false prophet Gordon Chang.

And if we’re also speaking to our cherished theme of intelligent portfolio diversification, we must add to our daily grind an awkward but necessary question – how much less risky do U.S. markets look right now?

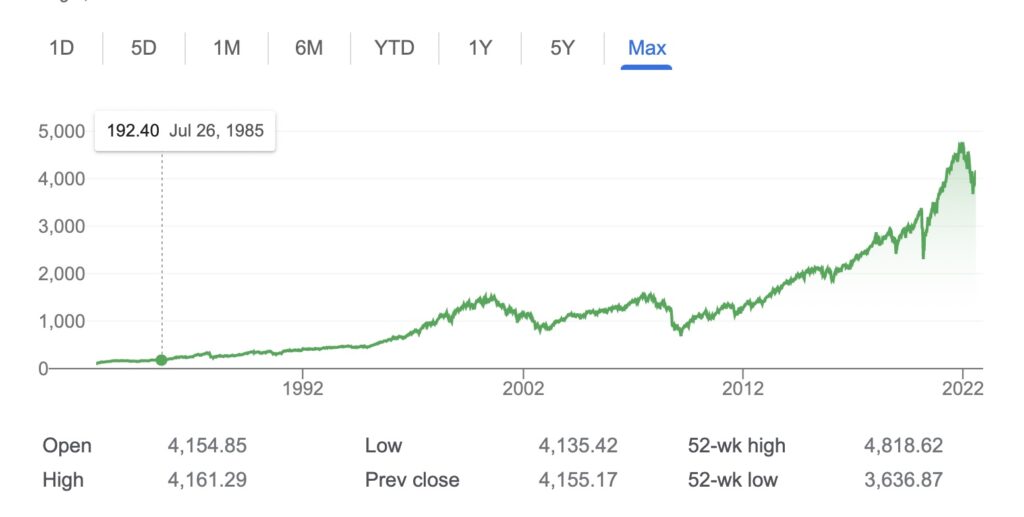

The definition of recession has just been changed to deny America is in one. Whichever way rates go – up just enough for some cosmetic deflation, as things look today – this much is clear: the Fed can no longer fire-carry the S&P 500 to double-digit growth. The former’s once strong QE legs are tired; the latter is bloated and overvalued beyond all recognition.

This is not to deny the miraculous power and popularity of the dollar, nor to suggest that technical takes on a peaky-looking chart should be considered sound investment advice. Rather, we can’t help noticing that the rundown on risks facing China versus those facing America are increasingly tit-for-tat.

Housing crisis? At least those Chinese suspending their mortgage payments can ostensibly continue to pay for homes they will own. Meanwhile, Blackrock has replaced the millennial as the American homeowner of tomorrow.

Demographic crisis? China has too many overeducated youngsters and not enough suitable jobs, so they’re “lying flat”, not unlike their zoomer compatriots overseas. We’ve been hearing about China’s senior burden since Chang was still taken seriously off Stanford campus and outside NBC studios. Meanwhile, a senior crisis is right on America’s doorstep. The trope that immigration will address America’s declining work-aged population ignores the many added challenges attendant.

Energy crisis? America has to untangle a decade of underinvestment in fossil fuel production, and reflect on what its embarrassing embassies to Venezuela and Saudi Arabia entail. China is favorably positioned with both those countries, as well as Russia and Iran, and has decidedly less pressure to magically transition to renewable energy with three claps of Klaus Schwab’s well-manicured hands.

Walking a Fine Line Requires a Balancing Act

Whether or not you believe U.S. markets are due for a big leg down, or that inflation will not be reigned in and continue to eat away at earnings, we propose the thesis that depending on continued growth of S&P beta constitutes poor risk management.

One of the tough things about China A-shares is that ETFs were never a good strategy. The market is just not efficient and institutionally invested enow for that kind of common-sense pricing.

The good thing that comes from the tough thing: active management works wonders in the Chinese domestic market. Four-fifth’s daily volume from retail traders alone sees to that. So we’re admittedly a bit misleading in constantly referring to the dowdy CSI 300 as a benchmark. That panoply of banks, insurance companies, and booze behemoths hardly represents the opportunity in China’s economy.

Yes, that economy is currently stagnating under zero-Covid, and its growing exclusion from the rules based order. But consider the corollary of the government’s ability to “crack down” on wayward tech and education companies – an ability to spur and stir tailwinds towards industries deemed evermore vital to national interest: defense, renewable energy, deep tech, advanced healthcare.

There is long-term growth and hedging opportunity aplenty in such sectors. There are also award-winning asset managers happy to consult on what sort of separately managed portfolio in China stocks would best meet your allocation and risk profile. Contact info@tirith.capital if you’d like to learn more.