You can’t change minds, but you CAN change your risk-management profile.

If the Internet has taught us one thing, it’s that emotion trumps information. Of all the things you’ll see online, from wondrous to grotesque, you’ll never see a comment reading, “Aha, I didn’t realize that. You’re right. You’ve changed my opinion, thank you.”

This has to do with your finances, believe me. You only have so much energy to spare on being stubborn. Most of us waste it on socio-political opinions, and arguments. My High China Conviction self, and my dear father (sadly afflicted with senior-onset neo-conservatism), communicate chiefly by going tit-for-tat on whether China’s rise is a good thing or bad thing, until one of us hangs up in anger.

Despite our stubbornness, we’re both guilty of being late filing tax returns. We’ve both delayed making important financial decisions. We’ve each of us been victims, investment-wise, of our own irrational exuberance, undisciplined fear, and all-around lack of stubbornness when it comes to risk management.

I don’t mind confessing, because the ongoing fall-out in the crypto market so clearly shows how many others can also lack the right kind of stubbornness. All those bright minds, technical and financial, believing the worst could never happen, because it hadn’t so far!

Understandable – the right kind of stubbornness takes plenty of emotional energy. Even in the regular financial world (“tradfi”, as the crypto kids call it), cutting back on winning stocks, then allocating more to losers, takes the discipline of a five-star general. And it’s only really possible with a stubborn belief in principles, rather than opinions.

Those are easy to conflate, is the problem. “America is about individual freedom, and China is about collectivism. Free markets versus planned economy!” This is popular opinion masquerading as principle. Anyone who needs to be convinced that opinion holds little water should not be reading a newsletter titled High China Conviction. I certainly shouldn’t allocate stubbornness reserves to convincing them otherwise.

Instead, let’s turn to the principle of diversification. There are still holdouts who define it as roughly equal stocks and bonds, with the former comprising both growth and value, large- and mid-cap, cyclical and non-, some ESG to make a difference, all U.S. listed.

The visiting experts on great podcasts like MacroVoices who preached this kind of diversification, are currently making the rounds subtly claiming that they were also emphasizing holding plenty of cash all along.

The pursuit of a sound diversification principle demands we re-examine economic principles, as the once global economy regionalizes. So much information turning into opinion! The U.S. and Europe are heading for recession, at the very least rate hikes that mean the easy beta days are truly over. China’s locking down Xian and parts of Shenzhen, oh no! Wait- China’s reducing quarantine times, yes!

In such scenarios, it’s instructive to look at some larger trends, which may lead to difficult conclusions, depending on how stubborn your opinions are. U.S. markets have benefited from a long-cycle of hyper-financialization. It’s at the point where a listed-company CEO’s only job is to keep the stock price up.

Meanwhile, China’s charting to be the world’s largest economy, sooner than later. The view that the latest disaster – Evergrande? No, COVID, that’s right, will miraculously change that, and that tariffs will make the U.S. an industrial powerhouse again, and send China back to filling discount shelves at Walmart, is borne of the stubborn opinion that what has been must always be, because you liked it that way.

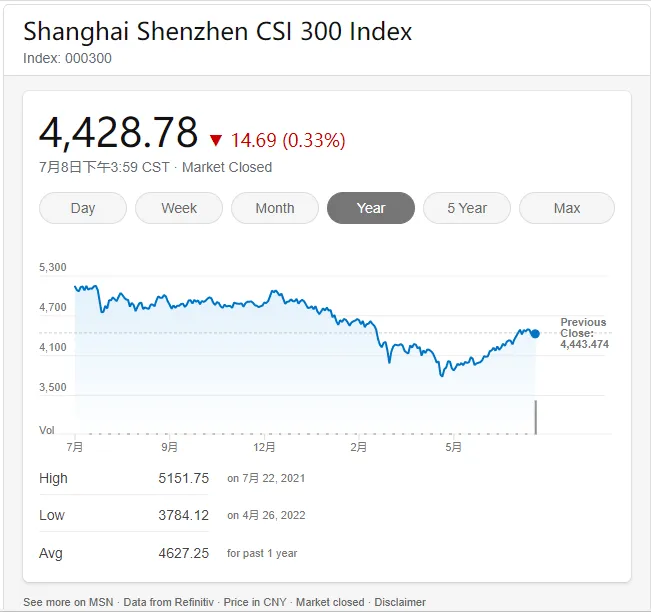

Be exceptional. Save the stubbornness for risk-management. China’s lowest COVID lows this year didn’t approach the lows of the first COVID drawdown, in 2020. Exposure to a rising power isn’t catching a falling knife at this point – not with the CSI 300 on an uptrend since late April:

That chart has slowing GDP priced in. “But geopolitical turmoil, U.S. inflation, rising energy costs!” All potential headwinds, to be sure. Who knows, though, which market will be most affected? Stubborn risk-management would dictate that exposure to both (granted plenty held in cash, thank you MacroVoices), is principled diversification.