The Tirith Beacon’s December 2021 Macro Wrap Up

The only thing more precious than gold (and Bitcoin) is time, especially holiday time.

So we’ve packed this month’s macro takeaways into as brief a format as possible, with an open invitation to get in touch and find out more.

Here’s wishing you and yours health, wealth and happiness in 2022!

China’s 2021 Challenges: Pros, Cons, and a Pro

Real Estate

Pro: Ongoing defaults and volatility in the sector seem likely, but not a greater-financial contagion. Local governments and central policy are taking measures to reduce blowback.

Con: With so much of China’s wealth tied up in real estate (70%), there can be no controlled landing. It is still too early to see the broader impact of the collapse of Evergrande and other over-leveraged developers.

A Pro: “Ironically, it is precisely because past lessons (the Japanese real estate bubble and the 2007 GFC) are so vivid and relevant that these painful historical episodes are less likely to be repeated in China. The Chinese regulators are neurotically fixated on avoiding the Japanese real estate crash that derailed the rise of Japan Inc. – Jason Hsu, Smart Beta Pioneer (full article).

Slowing Growth

Pro: Allowing inevitable GDP slowdown and maintaining relatively conservative monetary policy is a painful but prudent strategy for a shift to quality growth, and long-term economic stability.

Con: Slowing GDP momentum will drag down infrastructure, exports, and consumer demand, leading to overall economic stagnation and deepening financial problems.

A Pro: “Slowing growth is painful but planned for. As for A-shares, modest inflation, sound business fundamentals, and a broad plan for growth of the domestic market mean healthy, if volatile, growth in equities for the next five to ten years.” – Allen Kuo, Tirith CIO

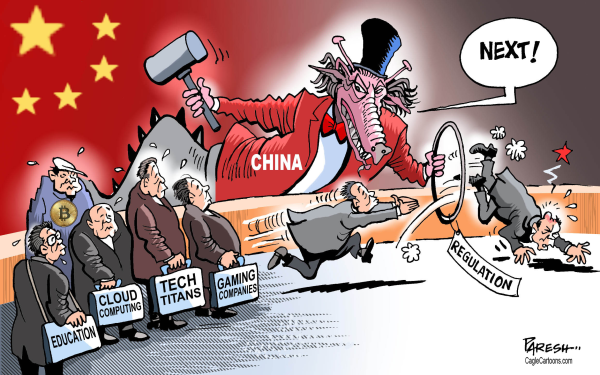

Crackdowns:

Pro: Although lacking the due process Westerners expect, the increasing regulations on big tech platforms, whether providing financing, ride, or education services, bespeak a larger commitment to healthy competition and market stability.

Con: The crackdowns reveal a regime that views tech giants as a threat to its power. The government has no reservations about reneging on investor interests to maintain authoritarian control of the markets.

A Pro: “The reality is that these businesses are actually much healthier, and that the framework for understanding regulation is far more predictable than is being espoused in a lot of these Western media sources,” – Bruce Liu, Esoterica Capital

Sound Bites: Hearing from Those with Money, Not Viewers, on the Line

We’ll Give You The Bad News First….

The Bad News: the ongoing property slump, sluggish consumer demand, and fresh outbreaks of COVID mean even more economic stimulus may be needed than the $188b injected earlier this month.

BUT

It turns out China exports and imports grew faster than expected in November rising 22% and 32$ YoY, respectively, beating expectations handily. Also, with less than 2% monthly inflation, the People’s Bank can well-afford its Dec 20 move to lower the loan prime rate, with room for more easing in 2022.

The Bad News:The SSE is up a humble 4.21% YoY, and the Shenzhen Composite only 2.25%, compared to the Federally-insured S&P 500’s mouth-dropping 28.43%.

BUT

The HK50 is down almost 15% YoY, and more than 25% off its mid-February high, which the NASDAQ China Index almost matched by falling 24.28% YoY.

We’ll be back with our market wrap-up as soon as the numbers are out, and looking ahead to the Year of the Tiger. Thanks for reading!