Locked Down, But Not Out, in Beijing

China’s May Holiday usually means Spring-Break style revelry for all ages.

A time when only F&B, tourism, and retail are open for business.

The rest of us relax, and delight in a New Year Festival do-over, minus the sharp weather and onerous family obligations.

So as China slumps into a May holiday with the only acceptable travel a trip to the nearest testing station, you may imagine a gloomy, panicked citizenry.

Indeed you needn’t imagine: we’ve seen the videos of Shanghai apartment screamers, empty grocery stores, and bags of pet cats waiting to be culled.

But your writer lives in Beijing, and is typing this in a community where unmasked children play (too) noisily outside, and their masked elders shop at the well-stocked corner groceries to be found in every apartment complex across the country.

And although a positive case in your writer’s community means I am “locked down”, with the rest of the two thousand-plus residents, the air is one of stoic patience, not panic.

Perhaps it’s the promises, backed by evidence, of continued logistics efficiency, a lack of which plagued Shanghai. Most ecommerce deliveries take significantly longer, but not the all-important food delivery, be it from local supermarkets or restaurants.

Perhaps it’s that Beijing has levelled out at around fifty new cases a day, and the obvious fact that this variant is about as likely to kill as the flu.

Whatever the reason, stoic patience prevails. You can see it in the mile-long but orderly lines of people waiting to get tested (sans military or police presence, believe it or not.) Or in the endless stream of social media videos offering personal takes on what to do with a May “staycation”.

And given that patient sentiment, the prevailing sentiment of panic that keeps China’s onshore equities in the doldrums underlines an enormous disconnect.

Now, that disconnect is relatively easy to understand, in terms of the retail traders who make up roughly 80% of daily volume. Market-chasers, by and large, their trading strategies barely deserve the name. You would mislabel to call them “investors”, as they are more rightly speculators, driven by false hopes of outsized short-term gains to try all manner of stock-picking tactics.

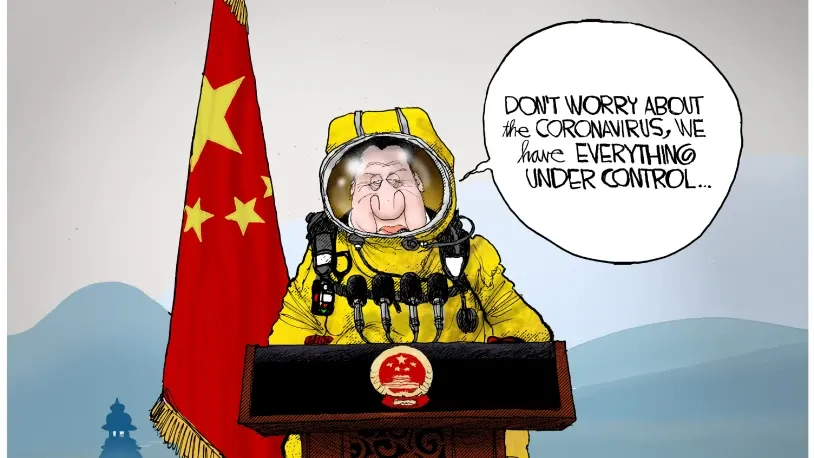

Sadly, the disconnect for offshore investors in onshore equities is easy to understand, as well. Every short-term setback to China’s economy gets “the sky is falling” treatment in western mainstream media. Yes, China is the last country standing to vow to beat COVID. Yes, that massive top-down effort means widespread economic slowdown.

But who, besides frantic news commentators, believes that China is ready to sacrifice its five-year plan, or long-term economic future, on the altar of COVID-free? Perhaps the many ready to believe Evergrande’s collapse spelled doom for China markets, if not the world’s. Those same many who failed to deduce that the government’s “Three Red Lines” policy aimed to pop bloated developers, the year before Evergrande failed. The very many who obsess over China’s slowing GDP, when the new five-year plan calls for doubling it in 15 years, as opposed to the last target of 8 (it took 9.)

The many decide quickly on the news, but neglect to look beyond the news story. For instance, I’ve heard frequently the factoid that the MSCI China index has plunged to roughly the same level of five years ago. Not mentioned at all is the much lower level less than four years ago, when Trump and the trade wars were sure to tank China’s growth prospects. Nor that it’s higher now than during China’s first bout with COVID.

In short, the many lack a necessary trait for successful investing, often called unemotionalism. Unemotionalism is a prerequisite for what most great investors do – practice contrarianism, which is doing the right thing even though the crowd is doing the opposite.

Now is the time to be examining China’s 4,000+ onshore stocks for value opportunities. Few, if any, are in the MSCI China Index, let alone the slew of banks, securities, and booze companies comprising the CSI 300. Those who can readily accept shuttered Chinese businesses and clogged ports as a temporary phenomenon, and envision the rebound, will find them. Our fund managers certainly have. But then they are all disciples of unemotionalism. “Stoic patience,” if you like.