A most under-publicized video, to match an under-publicized China narrative.

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

EXIT, STAGE LEFT. ENTER, STAGE RIGHT?

The well-publicized “purge” of former President Hu at the 20th Congress has caused extreme discomfort, and losses, on the Han Seng and the benighted Golden Dragon Index.

It goes to show that actions speak louder than words. With that in mind, do observe this action…

That’s Hu Jintao returning to vote for the new leadership, to the thunderous applause of the assembled Congress.

Here’s the whole video, Hu votes at 0:24-0:27.

Was Hu escorted out, chastised with extreme prejudice, then led back in to vote unwillingly? If so, what would be the point of the whole so-called “purge”? Purges are used to show the purged are gone and no longer relevant. Or was that video put together as an elaborate fake? Again, what would be the point?

There is much elaborate faking behind the official narratives we’re all enjoined to believe nowadays. And much information left out that doesn’t fit the narrative.

The market reacted predictably to the so-called purge. The mainstream narrative won, again. It’s comfortable to believe the narrative. But rather than debate which narrative is correct, let’s turn to the profitable.

WHAT’S YOUR FREQUENCY, KENNETH?

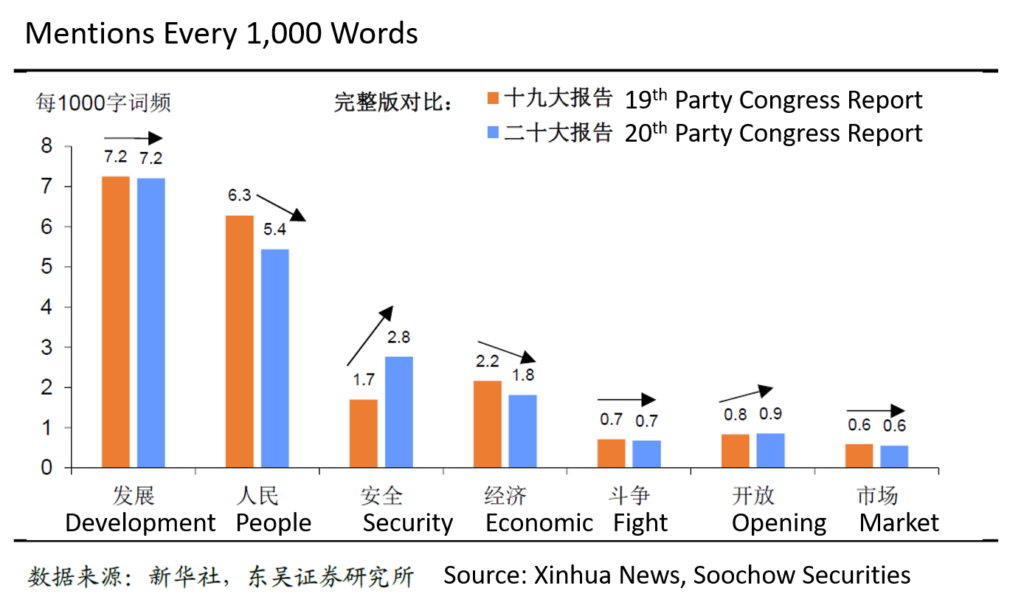

I’ve shown you few who are watching an under-publicized action that speaks quite loudly against the official narrative. Time to analyze some words and numbers, high-level but very telling:

The legacy media would have us believe: “ Putin wants to take over all former Soviet territory.”– make that: “Xi has clearly indicated economic progress is off the table, and it’s time to macht krieg.”

The word-count would have it otherwise. True, there is an awful lot of sloganeering during these endless congressional work reports – “cultural-ethical advancement”, “common prosperity”, on and on, to the closed eyes of many representatives in attendance – they’re not concentrating!

But hidden in the word salad are the main ingredients, as shown above. Those words are bursting with portentous flavor, to wit:

Development:

the clear winner, mentioned just as much as it was five years ago.

Meaning: an emphasis on high-quality, technologically-led, educationally-supported growth, not just GDP boosting. The word came in sentences with “new energy” and “green energy” as well.

People:

mentioned almost a full point less than five years ago. Obviously people matter less now in China. Pure collectivism beckons. Kidding.

Meaning: often-mentioned along with “development”, to supply the “talent”, which was mentioned 24 times in the report, via the improved “education” mentioned 42 times. Common prosperity is still a top goal, and it’s not going to happen by investing in real estate, a phrase hardly mentioned during the report.

Security:

Up a point, no surprise. Pray keep in mind the legacy media shaping the “China bad” narrative serves the sanctioning, rules-based-ordering U.S., who hears Taiwan war drums strangely silent in the Middle Kingdom itself. It also serves the UK, which has also recently decided China is an official threat.

Meaning: “security “was mentioned chiefly in regards to food and energy security. Little wonder, given the specter of non-transitory inflation and re-shifting global supply dynamics.

We interrupt this speech analysis for a highly-prescient word on inflation from Louis-Vincent Gave, on a recent episode of Macro Voices:

The Chinese regime is down to being the last inflation hawk…Who will have the cheap cost of energy looking forward?…Number one, whoever accepts the trade with Russia, which in essence is China and India. Number two, who will have cheap energy? Whoever turns back to coal…You have to invest in the countries that are going to embrace tomorrow’s cheap form of energy.

Economic:

down almost half a point

Meaning: the economy has been de-prioritized to focus on invading Taiwan!

Forgive the tongue-in-cheek; “We will work to expand domestic demand and better leverage the fundamental role of consumption in stimulating economic growth,” is a direct (translated) quote. The term “new industrialization’ was also bandied about, taken by pundit consensus to refer to ramping up chip-making capabilities and other tech self-sufficiency critical to the more oft-mentioned “security.” This bodes well for domestic equities, in our view, albeit aggressive western policy headwinds promise ongoing challenges.

Fight:

same frequency as five years ago.

Meaning: Can’t we all just get along? We can, and want to (according to the report), as long as China’s internal and much-more-mentioned “security” is not directly threatened. Our Taiwanese co-founder continues to reside in Shanghai with the same optimistic sangfroid he displayed five years ago, when “fight” was mentioned the same number of times.

Opening:

up ten beeps. The trend is your friend.

Meaning: whatever your druthers about who and how many are managing it, integrating more fully into the global economy remains a priority. On a national front, those closing their doors on China may well not find as open an embrace as those who return the opening sentiment, such as the many new BRICS hopefuls.

On a financial front, Axa Investment Managers & BNP Paribas join a long list of international AMs all-in on wealth management JVs in China, while China securities regulators are drafting rules to make short-term trading more accessible to foreign mutual funds.

Market:

unchanged from five years ago.

Meaning: whether domestic or international, markets matter to China’s leadership, for the capital formation, value creation, and trade growth that will underpin that which is hoped for by the more commonly used verbiage above.

A final word – “diversification”.

Now that you’ve heard from the translated horse’s mouth that, barring the stage drama, China’s plans remain little altered from the work report of last March, and no doubt see global dynamics shifting, we’d like to reiterate, as we so often do per 1,000 words, that the China domestic equities market is not one write off on the strength of one antagonistic side’s narrative.