The real meaning of Dragon’s day, and its effect on China sentiment

A brief China culture lesson – stay with me! Today is the Dragon Boat Festival, and if you understand the Dragon Boat Festival, you understand much about Chinese sentiment.

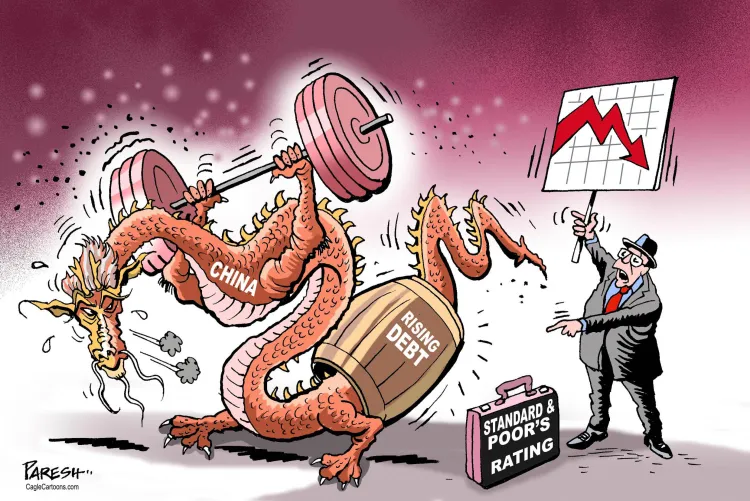

Sentiment, of course, has been the key force holding down Chinese stocks since China’s amazing rebound from the first round of COVID, followed by another shocking decline. The key sentiments – feelings, if you like:

1. Deglobalization Lite: Supply chain disruption, demand shocks, can China ever recover?

2. Deglobalization Dark: China’s going to invade Taiwan. Even if it doesn’t, America’s going to act like China’s going to invade Taiwan. Risk off! Risk off!

3. Cult of COVID-Zero: Whatever inscrutable reason China has for going all out to beat COVID (wasn’t everyone committed to going all out, before they suddenly weren’t anymore?), it will be Priority 1 for the long term.

OK, so the dragons have to wait. Because feelings are fine, but we’re talking about money, not a soap opera. Therefore, we must acknowledge our feelings, the emotions they trigger, and then apply reason, to wit:

1. Deglobalization Lite: We’ve been through this fire drill. Anyone remember Trump’s “Trade War”?

a. The CSI 300 sank to 3010 in late 2018. almost exactly 25% lower than its COVID-Zero low of 4016 on April 1 of this year (fitting date, that.)

b. It then steadily climbed to 5300 in early 2021, including an early 2020 COVID-I dip to 3600, 10% lower than we’ve sunk on this latest “China’s doomed” cycle.

2. Deglobalization Dark: Even Americans busy protecting their machine gun collections might agree that the U.S. is a far more chaotic and unpredictable place than China right now. But is it unpredictable enough to go to war with China? America is currently dialing down a proxy war with Russia, fought mainly by sanctions. Note only 45 of the UN’s 193 members voted for those sanctions.

Meanwhile, the ruble is back to its normal range against the dollar. The threat to China from America’s current model of warfare is existential, but how detrimental, long term? More detrimental than going to war with its largest trading partner would be for America’s markets, let alone its economy? In any event, that would be a “spread your bets” scenario.

3. Cult of COVID-Zero: China’s second-in-command just Zoomed 100,000+ officials with tax relief and policy loan plans. Premier Li went so far as to admit China’s looking worse off than during its first bout with COVID. Printing trillions of dollars and handing out stimulus checks are off the table. China’s nowhere near that desperate.

The third feeling is the one we empathize with the most. Our sentiment? “Conviction check.”

If you think THIS is the event – not Evergrande, not the Trade War, not a score of setbacks going back to Gordon Chang’s seminal 2001 Coming Collapse of China – that will send China spiraling into economic obscurity, fair enough. Chang has tenure at Stanford for writing China obits. It’s big business for him and news media, but not for financial institutions, who know a value market when they see one.

Oh yeah, the dragons. If you Google “Dragon Boat Festival”, you’ll see a lot of baloney about the poet and statesman Qu, who killed himself rather than accede to his emperor’s traitorous plans. The peasants, overwhelmed by such patriotism, fed their precious sticky rice to the fish in the river where he drowned, so that his body would remain pristine.

Notice the lack of dragons in that story? That version is a mere 1.5 millennia old. Dragon Boat day is a double 5 on the much older lunar calendar. It is a day of luck, if you play your cards right. The ancient strategy is to propitiate the Water Dragon on this day. Of the four celestial dragons, the Water Dragon is the healer, the regenerator. Eternally patient, he grants good fortune to those who show similar patience and faith by sacrificing some sticky rice to his domain.

China COVID cases are at new lows. Lockdowns are lifting. Pre-IPOs are bubbling up again. A turnaround is in the water, in the air. No hard evidence yet. Call it a feeling.