Re-globalization is a call to embrace uncertainty.

Geopolitics: Thesis & Antithesis

America vs. China, the Global South vs. the International community – a weighty, hairy, scary subject, but today a necessary starting point for top-down portfolio construction. To best summarize, we turn to the latest China Collapse head cheerleader, Peter Zeihan, and his tripartite THESIS*:

“i. There is no technological future for China; Biden killed that

ii. There is no energy future for China, Russia killed that

iii. There is no financial future for China, they killed that with their housing market.”

*per recent Real Vision interview

ANTITHESIS

i. according to the anything-but-China-friendly ASPI

Our research reveals that China has built the foundations to position itself as the world’s leading science and technology superpower, by establishing a sometimes stunning lead in high-impact research across the majority of critical and emerging technology domains.

China’s global lead extends to 37 out of 44 technologies that ASPI is now tracking, covering a range of crucial technology fields spanning defence, space, robotics, energy, the environment, biotechnology, artificial intelligence (AI), advanced materials and key quantum technology areas.

ii. According to Reuters:

Saudi Arabian oil giant Aramco affirmed on Sunday its support for China’s long-term energy security and development, the company’s CEO Amin Nasser said in remarks made before a forum in Beijing.

We’ll leave Russia and its cozy new relationship with Beijing out of the preceding, allowing for the ever less likely chance the former will be too crippled by war to supply China (and India, et al).

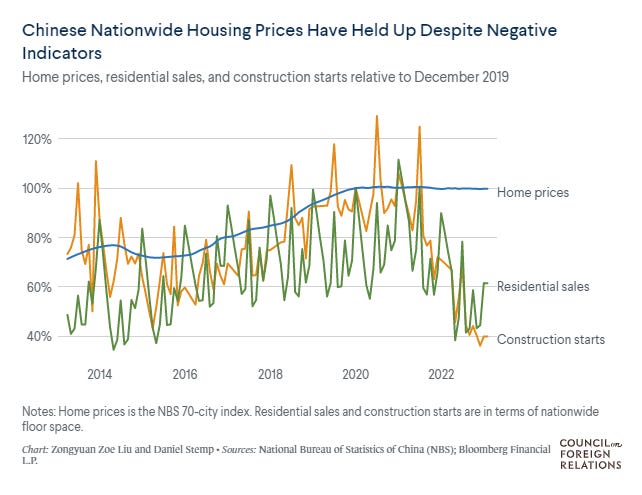

iii. According to the CFR:

Of course, there is much more to be said for how China is managing what is turning out to be a bumpy, but not hard landing, of the biggest real estate bubble in history. We posit the graph above signals that the latest iteration of the economic crash via said bubble, promised since 2001, is still largely in the heads of wishful thinkers.

SYNTHESIS:

What has been killed, or at least rendered moribund, is the possibility of a shared future between America and China in tech, energy, and financial growth.

What is being born in its place is a new order best characterized as Re-globalization. It is an order driven and led by China, be it ongoing expansion of BRICS, the increasingly relevant Shanghai Cooperation Organization, or the shockingly under-acknowledged detente between Iran and Saudi Arabia.

TAKEAWAY:

With American markets almost entirely at the mercy of a cornered Fed, the rest of the ‘20s look anything but roaring for western equities and bonds, for the first time since many of us have been alive.

For institutions that can embrace the reality of a more multipolar, antagonistic world, the impetus to form a bold, informed thesis for global diversification has never been more compelling.