China’s fall will be anything but surprising…

It’s heartwarming to see the Chinese and the anti-Chinese at last have something in common. They’re both waiting for the fall of China.

Here’s the rub: Chinese await the real fall, in October, when the 20th National Congress will augur the country’s path for the next five years. Anti-Chinese are still waiting for The Fall, the “inevitable” crash of China’s economy, after which the kindest among them predict a Japan-like stagnation to follow.

WHY WAITING FOR EITHER FALL IS SILLY

The anti-Chinese resemble gold bugs, too emotionally invested in the narrative to look at news, numbers, and trends in any holistic manner. For example, it’s nigh on a year since Evergrande was going to trigger the systematic collapse of China’s economy. The more recent mortgage protests and local bank failures have been remedied without massive bailouts, unless $29 billion staggers anyone reading.

Granted China is so far pulling off a bumpy, but not hard landing of the largest real estate bubble in history, waiting for the fall is a bit silly at this point, if understandable. Only the best investors can entirely untangle their thought processes from their emotional processes.

This holds true on both sides of the Pacific. The Chinese are waiting for the fall meeting before making any major financial decisions, which is a bit silly, too.

Does anyone expect any big surprises? Not really. The unprecedented third term announcement is that surprise party everyone, including the guest of honor, knows about. And the reshuffling of Li Keqiang and other key leadership will signal no dramatic policy repercussions.

Yet otherwise rational Chinese institutions and investors all view the proceedings to come on October 16th as the tea leaves of a cup for 1.4 billion, sheep entrails to be examined by the esoterically versed. Only afterwards can significant investment decisions be made, particularly those related to overseas investments. I tell you this as one who offers such opportunities to Chinese institutions. “Wait until the fall meeting,” is the shibboleth, much as “Let’s wait and see” is the shibboleth among western investors with some China conviction, but not enough to pull the trigger on A-share diversification.

CHINA POLICY PREDICTIONS

It’s easy to play Nostradamus when it comes to China government policy, at least at the national level. The government tells you ahead of time. You can play, too. Just read Premier Li Keqiang’s Report on the Work of the Government from last March.

Too busy? No worries. The one word that comes up almost as often as “China” is “stability” – in context: “ensure stability”, “guarantee stability”, “financial stability”, “economic stability”, “employment stability”, on and on.

Of course, interpreting what China views as stability is where things get interesting. Alas, the entrails portend that being a compliant vassal of the Rules Based Order does not mean stability to the CPC. Quite the contrary, in fact. Thus, expect a large push to self-sufficiency over the short-to-mid term. Tech (especially chip), renewable energy, and agricultural self-sufficiency are all priorities now. Where China can’t be an island, it will take steps to reconfigure supply chains, for stability. Predictably, FT has already done a nice piece on this concept.

That’s where the opportunity lies in A-shares, but I must address an edge case first. “What about the COVID lockdowns? How’s that promoting a stable economy?” I can hear someone asking. In response, I point to the Brookings Institute, which claims some 16m Americans have long COVID, accounting for 8% of working Americans, with up to 4m currently unable to work due to its effects. Conclusion: long-term stability often requires short-term pain. Now that China’s the strange one for not giving up on COVID, the masking and health-coding will continue until there’s a vaccine a touch more trustworthy than Pfizer’s.

In any event, expect Xi to mention “stability” more than “COVID” in his triumphant address, and for little, if any, variation on the Work Report already delivered.

TURNING STABILITY INTO STABLE GROWTH

So granted:

a) a quest for stability interpreted as more self-sufficiency in innovative tech/energy/agricultural solutions, &

b) an official commitment to becoming a global financial center

c) tangible steps such as the STAR Market, to drive stability-granting innovation via capital formation

It’s rather easy to predict that there will be significant government-generated tailwinds for related domestic companies in both primary and secondary stages. This will mean copious beta for certain China tech and energy sectors, and alpha outside of the familiar CSI300 and MSCI China Index, where alpha is still high, thanks to the 70-plus percent retail-traded daily volume.

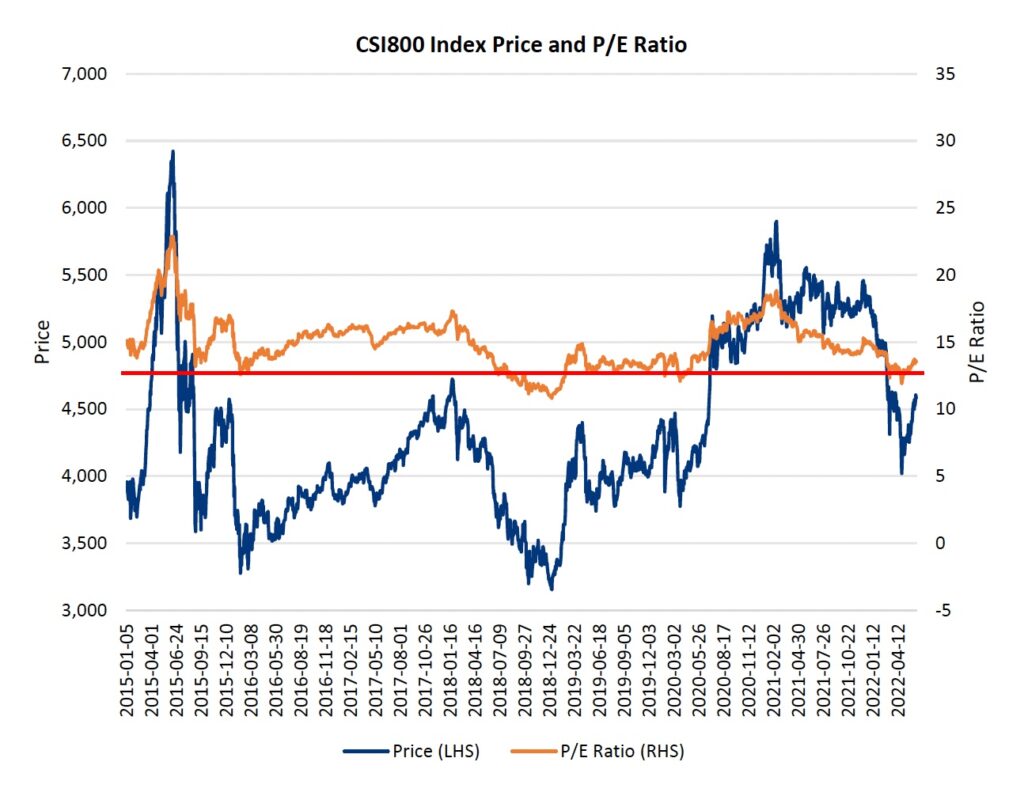

In the meantime, there is significant value in A-shares (beyond the CSI300), as shown below by top quant fund Mingshi:

Put it this way: average P/E ratios for A-shares hover around 13.3, while those of U.S. equities are closer to 30. Even with the recent leg down, many NASDAQ stalwarts are trading at valuations only Cathy Wood could love.

It’s a risk off environment, but as our friend at Rayliant, Jason Hsu, so succinctly puts it “Selling after prices have collapsed is pain management, not risk management.”

I’d like to leave you with more of the good Jason’s advice (ibid):

Remember that in investing, you have only two options: lose money fast, or compound returns slowly. Diversification remains the only free lunch in investing, and it has always been (and is likely to remain) the best way to successfully weather turbulent markets and capture juicy opportunities.